Wow, been sometime since i blogged. Lots of things happening in real life that got me sidelined from blogging.

Addition to the family:

Welcomed my daughter to the family in November. A bundle of joy. To make this post remotely finance-related, i shall classify her as a 21 year endowment plan. Returns on investment, unknown, and no projection available as well.

Cost of investment: Very high.

I think it's not an investment you will go into based on the numbers alone. I mean, the initial outlay into this is

quiteeee high.

Giving a rough breakdown of the costs associated, and i give only approximate figures here:

(1) Regular gynae check-ups: 250- 350 a visit. Roughly 12 visits (monthly, then moving to shorter intervals as the due date approaches)

Total for check ups: $3,600

(2) Miscellaneous medical costs associated: Pre-natal check-ups. There used to be an oscar test to test for Down Syndrome, which costs about $300-500 and have a 75% accuracy ration, we decided to go for the Harmony test. It costs $1,500, but have 99% accuracy reading. That plus other supplements/tests/scans that needs to be undertaken.

Total miscellaneous medical: $2,000

(3) Nursery room: Outfitting a room for the new member costs money. Baby cots, dressers, clothes, strollers. These things do not come cheap

Total for nursery: $5,000

(4) Food expenses/supplements: Grocery bills went up. Went marketing every week to buy cod fish for the wife to eat. And that is like.... premium. Bird's nest, Chicken Essence become par for the norm. I did not track this expense though.

(5) Cost of delivery: Went for delivery at a private hospital (Thomson Medical). Apparently it is one of the more affordable private hospital compared to the others. Cost of delivery varies depending on the complexity of the procedure, i.e., if you are going for a caesarean operation, normal delivery, with or without epidural (anesthetist required)

Total for delivery: $9,000*

*Note: Medisave could be used to help defray the costs up to $3,000 for normal deliveries. More could be used for Caesarean-section deliveries.

You would have noted that i did not exactly scrimp and went for the lowest cost option. Decision was not made on cost as i think being pregnant is not easy, and paying (quite a bit more) for comfort would help go a long way to making the process for the wife much better.

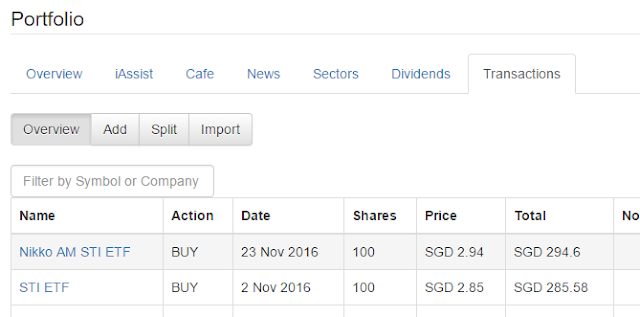

There are ways to save on this: going to a public hospital (delivery and gynae check up costs would be much lower), but weighing between the 2 i consciously went for the more expensive option. Sure, it could have helped purchase a few lots of STI ETFs perhaps... maybe 20 years later i would rue the choice, but i guess some decisions have to be made.

So what's the total cost i incurred for this 'investment'?

A whooping $19,600.

And going forward, there would be monthly 'cost averaging into this', and who knows the potential payout 21 years later?

Economically, i think the maths don't work out. ;)

To balance this out a little, the government does help out a little.

(1) Baby Bonus: $8,000 for the first born, spread over several tranches disbursed

(2) Child Development Account - $3,000 first step incentive into the child's account, plus up to another $3,000 dollar for dollar matching

There are tax incentives given for parents with babies, which will help out a little